CIDCO Transfer Charges are compulsory in Navi Mumbai for purchase/sale of all types of real estate – Shops, offices, flats, plots etc. Without the payment of CIDCO Transfer Charges, no property transaction is legally sound or complete. Do not believe fake news and chor politicians who have zero understanding of the law and whose only job is to fool the uninformed people with lies.

CORRUPTION IN CIDCO

If you think that police and municipal authorities are corrupt, they will pale in comparison to the loot going on in CIDCO…. and that too under the very nose of the so called \’Vigilance\’ department of CIDCO located on the 6th floor of CIDCO bhavan in Belapur. Anti Corruption Bureau of Police regularly raids and catches staff in this building..right under the nose of this so-called ’Vigilance Dept’.

In this situation, it would be safe to say that the Vigilance Dept of CIDCO is also corrupt. The fence has eaten the crop.

And if you think that only the low down employees are corrupt, try fixing an appointment with the MD of CIDCO.

The Municipal commissioner is available for public meeting between 3-5 pm everyday without appointment.

The Police commissioner is available for public meeting without appointment daily between 3 and 5 pm…but CIDCO MD is in a whole different league.

Understand this one thing clearly about bribes to CIDCO officials :

No CIDCO official will do anything that is illegal in exchange for money. If a CIDCO official is asking for money to do a certain thing for you, rest assured that what he is promising to do is legal anyways..but it just happens that you don\’t know about it. If you file an RTI, they will be obliged to tell you the truth. That is the reason why the Online RTI portal of CIDCO has collapsed. They don\’t want to tell you the truth. ..cause that will end their loot.

Amongst all this corruption, there are 2 people that deserve an honorable mention : Mr.Yatish Patil and Miss.Sneha from Kharghar Office. Both have always been extremely co-operative, ready to help, respectful, unlike the other staff that I have ever come in contact with. Extremely rare in CIDCO. No comments about the others.

After much delay from its set deadline of 1st April of every year, CIDCO finally released the new Transfer Charges for plots, shops and flats in Navi Mumbai region. These are valid on all properties bought or sold in Navi Mumbai. The rates usually go up 10% every year. They are calculated on the carpet area of the shop/flat and depend on the location. The Time taken to complete the procedure is stated as 20 days by CIDCO, but in reality it can take anywhere from 1 month to a couple of months due to the absolute chaos, TOTAL CORRUPTION and lack of systems prevailing in CIDCO offices.

Why ?

Because all land in Navi Mumbai belongs to CIDCO. They acquired the farmland from villagers starting back in 1970’s. They only give land on lease (long lease of 60 years) and hence they are like a giant landlord. Now logic should tell us that if we are sitting on a property that belongs to a giant landlord (in this case its CIDCO), it is but obvious that if you want to leave and make someone else sit in your place, you will need the approval of the landlord and abide by the lease conditions.

What happens if you don’t pay CIDCO transfer charges?

Well, that depends on whether you are the buyer or seller of the property and whether you and the buyer before you has paid the stamp duty or not. If the buyer before you has paid the transfer charges, then you don\’t have to worry. Just pay the transfer charges for your transaction and you’re ok. But if the seller has not paid his transfer charge (when he purchased the flat) then you are liable to pay it when you purchase the flat from him. Or else, you can ask him to shell out the money for his transfer.

So make sure that you purchase a flat only after checking that the previous owner has paid the CIDCO transfer charges. If you buy from the builder, you don’t have to pay transfer charges as it will be applicable after the formation of the society and at the time of conveyance of the land and building in favor of the society.

Sometimes even the banks are not aware of these transfer charges as these are unique to CIDCO areas in Maharashtra, and the builders don’t want to tell you at the time of selling the flat to you as they don’t want any additional expenses to come in the way of their sale. CIDCO transfer charges increase by approx. 10% every year.

Is there any other clearance required from CIDCO?

Yes. After obtaining the CIDCO NOC, you may require a ‘Mortgage NOC’ (if you are taking a loan from a bank). The bank will not disburse the loan unless you obtain this Mortgage NOC from CIDCO.

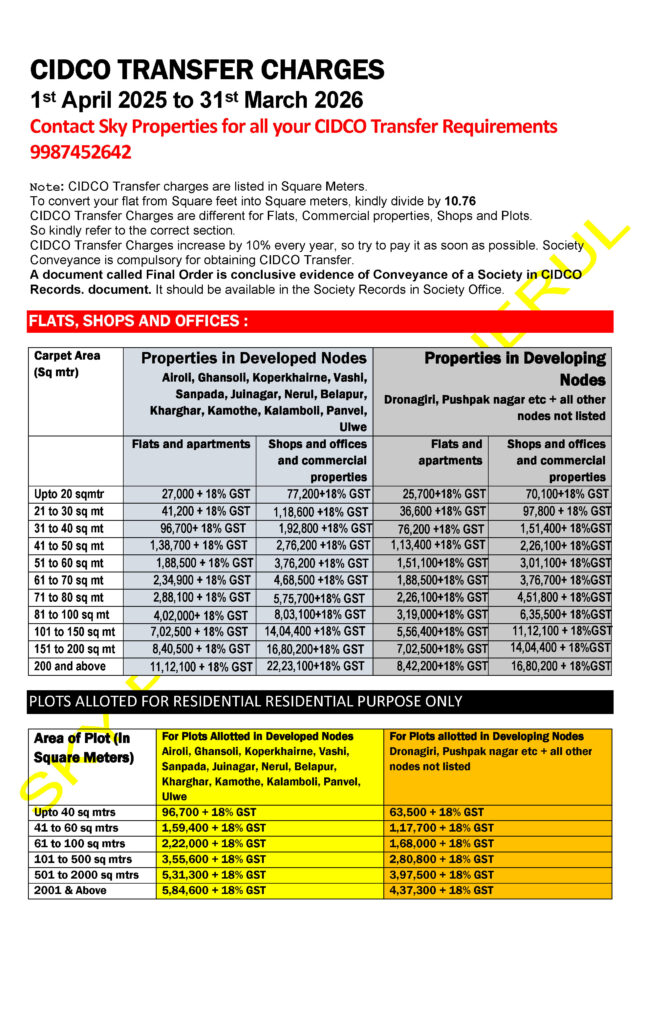

What do transfer charges depend upon?

They depend on the carpet area (not built up area) of the flat.

Is GST applicable on CIDCO Transfer Charges ?

Unfortunately, CIDCO has started levying GST of 18% on CIDCO Transfer Charges. It may help to note that before 2014, there were no additional taxes of any kind on CIDCO Transfer charges as neither is CIDCO selling you any goods and neither is it providing any service to you. Simply changing your name in Govt (CIDCO) records and taking money for the same is NOT a service.

But aren’t CIDCO Transfer charges abolished ?

CIDCO Transfer charges are implemented as per law passed in Assembly. Its called the New Bombay Disposal of Lands Act and New Bombay Disposal of Land Rules. To change that law and the rules which govern it, it will have to be altered in the Assembly.

CIDCO earns hundreds of crores via these Transfer charges, which is then spent on by CIDCO for developing the infrastructure and paying its staff salaries. So promising to ‘abolish’ it was just like a lot of other false promises made by ignorant and foolish politicians who have zero idea of economics. But these fake promises only work where the population at large is ignorant of basic laws.

When are these charges payable ?

These charges are payable after registration of the Sale Agreement (Part Payment Agreement) or in case of payment in one shot (No bank loan) it is payable after the Sale Deed.

Are all flats/buildings/societies eligible for CIDCO Transfer Charges automatically ?

No, the Society must have something called Conveyance and must feature in CIDCO records. More than 90% of Societies do not have ‘Conveyance’ in their favor in CIDCO records.

What is the conclusive document which shows Society Conveyance ?

Its something called \’Final Order\’, shown below..…

Are transfer charges fixed ?

No, they increase by 10% every year on the 1st of April (beginning of new financial year).

NEW TECHNIQUE FOR CORRUPTION BY CIDCO STAFF

Recently, it has been noticed that CIDCO officials make people submit physical copies of their application along with all the other affidavits etc. On visiting the CIDCO office, applicants are told to submit additional documents like :-

1.Share Certificate copy

2.Society Members List

3.Copy of Final order etc

All these demands are illegal. No official can make you submit more documents than listed on the CIDCO Website.

And anyways, the documents you submit also contain an Indemnity bond, which absolves CIDCO of any blame or responsibility if any legal or other issues crop up later. CIDCO has zero liability. ZERO. For what are they taking all these guarantees from an applicant if they want to become a CID office ? If they want to become CID office, then let them take responsibility for any problems later.

They may also give you frivolous excuses that Society is not uploaded etc. If your society has something called the final order, then all the responsibility of uploading and updating records falls on CIDCO. Its not your job or responsibility to upload or facilitate an internal process of CIDCO. Tell them its their job not yours.

If the CIDCO officials make these illegal demands, tell them to give them in writing on a piece of paper that they want all these documents along with their name, designation and date.

Tell them that you will approach the CIDCO MD / Vigilance Dept at Belapur HQ and complain to him/her.

They will never give you anything in writing….and will most probably tell you that they will manage without those documents.

If you manage to submit your complete application online, you will be asked to come personally to collect the NOC letter as \’the mail server is down\’ or \’your documents were not uploaded\’ some other excuse. They will never tell you this in writing cause there is nothing wrong with any mail server and your documents were uploaded properly. All they want to do is make sure that the person who has filed the application is not an agent (who is avoiding greasing their palms). You will only be called on so that the call cannot be recorded or sent a mail that your application is rejected as your documents were not uploaded . The best part is… once your application is \’rejected\’ .. your documents and entire application is also deleted. So there is no way of you verifying that your documents were actually uploaded or not. There will be nothing in writing. Once you reach the office, they will try to verify if you are an agent/lawyer. .. and if you are, they will make you cough up money. If you are not, then they will simply hand over the NOC in printed format to you and say goodbye.

If your application is rejected due to the reason of ’documents not being uploaded’, the only recourse available to you is to submit a fresh application. Following this, it is advisable to visit the CIDCO office promptly the next day and request them to verify the status of document upload in person (in front of you on the computer).

This approach is the most effective means of resolving the situation.

What you should do is tell them to write on the NOC that the NOC was handed over to you in person as the Mail Server was not working along with the date, time and signature of the official.. But they will never do it cause every technical fault is recorded. If you make a written complaint, an investigation will be done, their lies will be caught…and the culprit will either be transferred or sacked after inquiry.

To address any concerns or submit a complaint, you can access the online complaint submission portal . However, please note that while this platform aims to assist users, there have been instances where satisfactory resolutions to complaints were not achieved.

For more information on how to bring corrupt officials to book, click on this link for complete information.

Deadline for Issuing CIDCO NOC And MORTGAGE NOC

(Provided all documents are in order)

| CIDCO NOC | 21 Days |

| MORTGAGE NOC | 7 Days |

If your society does not have conveyance in its name along with Final Order from CIDCO…..

Even if your CIDCO society conveyance is not done, it is advisable to get all the documents for CIDCO transfer signed and ready as the seller may not be traceable if and when the society manages to get the Conveyance done after a few years.

Note : Conveyance of land and building in the Name of the Society is compulsory for CIDCO Transfer. The Only conclusive proof of that is a document called the Final Order. Without this document, no CIDCO transfer will be possible.

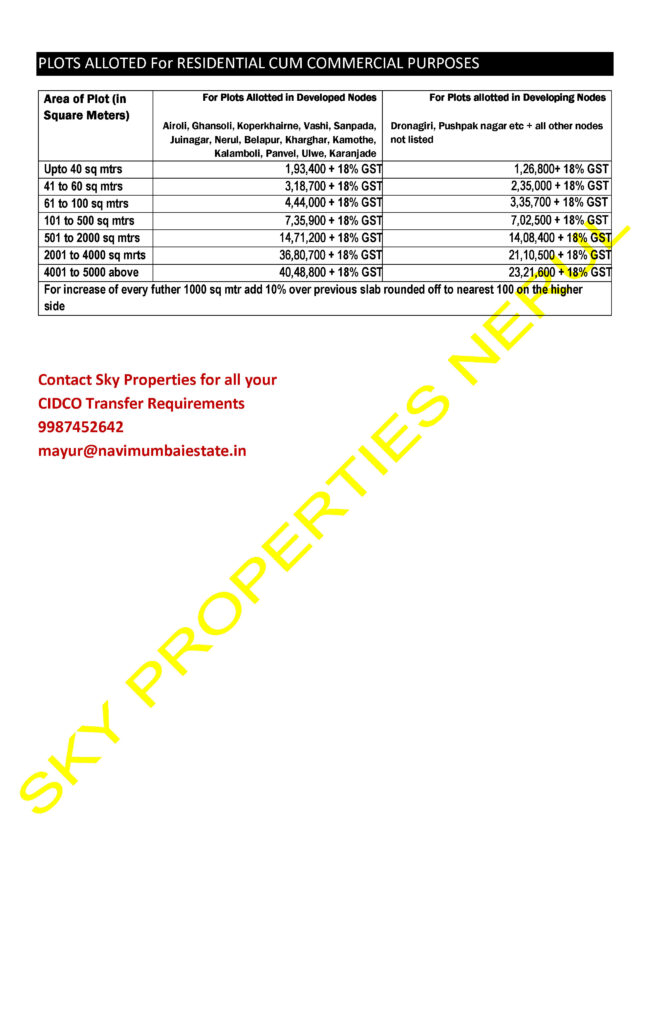

Current CIDCO TRANSFER Charges (1st April 2025- 31st March 2026)

CIDCO TRANSFER SERVICES

We can provide our professional services to facilitate CIDCO Transfer Process for a nominal charge of Rs 10,000 (all inclusive).You can pay online via Gpay, Phonepe or UPI and documents will be prepared and sent to you via courier in 2 working days. We only require a copy of the Sale Agreement for preparations of the Documentation. We only need a copy of your sale agreement/sale deed to process the documentation. You can mail a scanned copy or send it via courier.

CALL US 9987452642

| Service provided by us | Charges |

|---|---|

| CIDCO Transfer only | 15,000 |

| Mortgage NOC only | 15,000 |

| CIDCO Transfer + Mortgage NOC | 20,000 |

| Only Drafting/Documentation | 5,000 |

| Drafting and Registration of Sale Agreement/Sale Deed | 10,000 |

| Brokerage (Purchase/Sale transaction) | 2% |

| Brokerage (Rentals) | 1 month rent/year |

| Consultation over Phone/Whatsapp/Zoom/Google Meet | 5,000/30 mins |

At present CIDCO transfers of SS- 3

type home have stopped.So if someone wants to take a loan, will it be transferred to CIDCO?

CIDCO cannot stop transfers as per its whims and fancies. It has to give a solid and legal reason for stopping transfers.

Hello Mayur, thanks for the helpful information you posted here.

May I request your advice on the situation of my father’s plot in sector 1, nerul. My father is diseased. He had purchased the plot in sector 1 back in 1990. The seller is also deceased. My father did not do the title change in CIDCO so even until today, the name of the previous owner appears in CIDCO records. What is the procedure to get the plot transferred in the name of my father’s legal heirs? Or which department in CIDCO can give me the procedure?Would it be helpful if I contact you directly on your phone? Would really appreciate any info on this situation.

You need a document called Hiership Certificate from the court if your father did not make a will. If a will exists, you will have to get it probated from court. After that you will have to apply for transfer in cidco after paying minimum transfer charges. Hope this helps.

Thanks, Mayur. Appreciate your response. A quick follow up question If you don’t mind. The purchase deed between my father (deceased) and the original seller (deceased) was not “registered” – meaning it was just executed on some stamp papers (notarised) back in 1988 and it wasn’t recorded in CIDCO. Some lawyers are saying that the plot will have to be first transferred in the legal heirs’ name of the original seller (deceased) in CIDCO and then they will transfer it to my father’s legal heirs. Is this a safe approach?

Can’t CIDCO take NOC from the legal heirs of the original seller(deceased) and then transfer the plot in the name of my father’s legal heirs?

They are right.

Hi.

I am purchasing a 3bhk flat in kharghar from builder. What are the documents I need to get from Cidco after sale deed is registered? Also what are other services that need to be transferred in my name viz. Electricity or anything? Society is formed but conveyance is not done. Builder says that we have to pay to society for the conveyance. I am taking a loan from HDFC and bank has not demanded any Cidco transfer NOC or mortgage NOC in their document list. Please advice. Also, do you provide services for these works?

When purchasing from builder, you don’t need to get any cidco documents. But giving conveyance to society is builder’s responsibility, not yours or society’s. You can transfer electric connection. Thats what you can do now. Builder should’ve completed conveyance procedure to society within 6 months after formation of society. At his expense. Or else society should take him to court. The verdict will come in your favor and it will save lakhs of rupees as conveyance charges. We can provide legal services for this case against builder in consumer court. If you require the same, call 9987452642

Hi, is there any problem going on in the cidco because the cidco transfer process work is getting delayed from the past 1 year. Process is going on slow for releasing the final order.

If you bribe them, work will happen fast. There is no system or procedure in CIDCO as of now. Only bribes can guarantee that you will get your work done in time.

Hope this helps.

You can also try to lodge your grievance online at this link…and hope for the best.

https://cidco.maharashtra.gov.in/grievance_geportal/index#gsc.tab=0

What is 12.5 and 22.5% holding property and freehold property..

https://navimumbairealestate.org/2012/04/17/12-5-gaothan-scheme-of-cidco/

Hello sir, I purchased a 2 bhk under-construction flat in Kamothe and the purchase agreement is registered in favor of me and my father (co-owner) in 2015. Sadly, my father died in 2018. Subsequently, on the basis of Waras Dakhala (legal heir certificate) issued by Tehsil office, we registered release deed wherein my mother and brother released their rights (in father’s share) in favor of me so tat I became 100% owner of the flat since then. I submitted release deed to society in 2018. Society got conveyance deed registered in 2020. Unfortunately, society manager over looked my release deed (2018) and instead referred original purchase agreement (2015). Accordingly, my and my father’s name appears in conveyance deed against my flat. Now, for CIDCO transfer for 50% part (owned by my father), will legal heir certificate and release deed suffice so that I need to pay less transfer charges or do I need to pay the complete charges for 50% of the part?

Sorry to hear of your loss. Heirship certificate issued by court should suffice. The transfer charge will be only Rs 5950 in CIDCO.

Good luck.

Hello Sir,

I purchased flat in Kamothe. In index II, flat area is 49.40 sq mtr carpet + 8.82 sq mtr terrace. So should I pay cidco transfer for 49.40 sq mtr or 58.22 (49.40+8.82)?

Your transfer rates will fall in the 51 sq mtr to 60 sq mtr range.

The chart is on my website.

Pls spend 5 seconds to rate us on Google. https://g.page/r/CZMCF-mpuO5oEBM/review

Thx

Hey mayur thanks for the info, I’m a third owner of a flat in roadpali, and want to do cidco transfer but the first owner name appears in the records and he is not traceable. How can I get this done without the first owner. Thanks in advance

You need the second owner along with all his documents. We can do the same for you.

Pls call us on 9987452642.

Hello Sir,

I had purchased a Cidco Jn3 property in vashi in 2006. I then transferred it to my mother by gift deed in 2013. My mom passed away in October 2021 and I applied for heirship and got an order from the Thana court. I then transferred in Cidco the property in the name of myself and my brother. So the process is completed in Cidco. However the PROPERTY TAX BILL AND WATER BILL is still in the name of the original owner. How do I transfer this into the names of myself and my brother. Also do I need to pay any charges to NMMC.

Property transfer has to be done in NMMC.You will have to pay the transfer charges to NNMMC. First your property tax procedure has to be done and then Water transfer has to be done.

Charges are as per the built up area of your flat/house and Water transfer charges are approx Rs 800-900. We can undertake the process for you if desired.

If you found this reply helpful, kindly rate us on google at this link https://g.page/r/CZMCF-mpuO5oEBM/review

Thank you so much for your kind reply. I agree with you that CIDCO is one of the most corrupt organisations in India. I will try and transfer it myself. If unsuccessful then I will surely approach you.

Hello Mayur,

I have read many comments and thats really great of you for helping out common people with Real Estate guidance.

I have a query again with property purchase. So my scenario is as follows:

I am interested in purchasing a property of say 65 lacs in Ghansoli with carpet area 600 sq ft. in sector 19. And as per Ready Reckoner the Circle Price come out to be approx. 36 lacs.

So in this case what is maximum amount of Sale Deed be registered?

Reason for this is i plan to take loan of 50 lacs for this flat but not sure if bank will disburse the entire amount because of Circle Price being low.

What is possible way out in this case? Pls suggest the needful.

Bank will do its own valuation for the flat and come to a price point. They regularly deal with flats all over the place so they have a good idea of prevailing rates. Your income also plays a part. Generally half of your gross income is given as loan. Suppose your income is 1 lakh, you will get 60 to 70 lakh loan from bank. Defers from bank to bank.

If this helped, pls give your feedback on google ratings here https://g.page/r/CZMCF-mpuO5oEBM/review

Thank you for your prompt response and guidance. I will definitely give the best ratings based on user experience i had so far.

There is one follow up question : I see the price chart on this website for different services you offer but i was unable to figure out if there is a comprehensive package which would cover everything i.e document and legal verification, valuation, Sale Deed registration and CIDCO transfer, Society Name Transfer process etc.

And if you provide such a service what would be price breakdown or package cost for individual home buyers.

Thanks alot for setting up this forum for helping first time home buyers.

Thank you for the reply.

Yes we do have a comprehensive package which covers Everything from due diligence, verification, valuation, sale agreement, sale deed, cidco transfer and society transfer.,

Total cost of the same is Rs 60,000

Hope this helps.

Hi Mayur, you have been doing a wonderful job of sorting out the confusion and queries of Navi Mumbai citizens and saving their time !

In case ,the society registration, unilateral deemed conveyance in the favor of society has been completed,Index 2 has been registered.(12.5% GES)

Now plot transfer that’s final order is the remaining thing, correct me if wrong.

The agent appointed by Society Committee has completed this in 2013 ,but after that nothing has been done .File not found in CIDCO office ,number is available.It seems he has been sitting idle and telling some stories.

Is there any way to get it done at older rates of transfer if file is put up by him to CIDCO and CIDCO itself failed to do so in stipulated time, I know logically yes but for CIDCO ???

If he is still inactive and is not responding in future, can society demand for our money paid in advance ,having the proofs?any suggestions please!thought of writing a demand note and then moving ahead.

And how about metro maveja noc ,does it will affect this work?does CIDCO charge for that separately for older pending cases?

If we get money back or in any case, if we handover the final order work to you with all documents in place which were obviously utilised for deemed conveyance ,how much will you be charging the society in total for the CIDCO final order alongwith any new document requirement

Thanks!

CIDCO Conveyance is a very elaborate and lengthy procedure. Registering the conveyance deed is just one part. After that Transfer charges have to be paid to cidco. And then a lease deed has to be signed with CIDCO.

Without scrutiny of documents, its impossible to say where the process is stuck and what exactly is the issue.

Thanks Mayur for the prompt response.I understand without documents, you can’t confirm ,What’s needed for me at this point is the following,pls suggest if you can

1)Can we go with the older transfer rates if the work is stuck by CIDCO itself?

2)Is this Metro Maveja NOC mandatory?is this a new stuff?

3)Can we take action against the inactive agent and recover money in this case?

4)If nothing happens, can we handover this work to you for further proceedings of final order by CIDCO,how much will be your charges ?

Thanks once again for your valuable time.

Yes, you can pursue the agent for refund of your money if he has not completed the job as promised. For this you will have to engage an advocate and file a summary suit. This is a civil procedure and is quick. If you want to take this route, let me know and I will suggest the way ahead accordingly.

Few months ago I purchased cidco property in resale. All work related to purchase completed, I received NOC to transfer, mortgage NOC and final order from cidco. Few days ago I found that there is carpet area mentioned on NOC to transfer letter and its not correct. Will it create issue in future if I try to sell property as info is not correct on letter? Is it possible to correct that carpet area mentioned on NOC to transfer letter?

Did you mention this to the person who undertook this job for you ? If you did, then its his responsibility to get it corrected. Not yours.

Thanks Mayur for reply. Yes. I already informed person about issue in carpet area mentioned in NOC to transfer but person is not taking responsibility and ignoring. Is it possible to do correction?

Yes, you can apply for correction.

When will be tripalicate party amenty scheme for tranfering flat /apartment n cosco

Not anytime soon unless the law in changed in the Assembly. But that is highly doubtful.

Thanks for wonderful information

Thank you MK Sawant. It would be great if you could rate us on Google here. Thank you once again.

https://g.page/r/CZMCF-mpuO5oEBM/review

Mayur we have a flat purchased in resale in 2019. Society is registered in 2018. Now the society is going for conveyance. Still the process is not started. The agent doing the work asks us to pay the transfer charges. Will that be applicable for us even or shall we be included in the final list cz conveyance process is started now.

If you have purchased in re-sale then your name will not go in the original purchasers list. You will have to pay the transfer charges for your flat. Hope this helps.

Mayur, can transfer charges be paid before conveyance deed? Not even intiated

No.

I have completed my sale deed and paid stamp duty and registration charges as per law and society NOC was taken at the sale. My society chairman is asking for Cidco transfer documents. As per him I am not a member of the society unless I submit CIDCO transfer documents which is not possible without Conveyance deed. I am staying in the building and paying maintenance which is also accepted by the society. Is there any other cidco consent/noc required even if conveyance deed is not done by the builder?

Note: Ulwe, No Cidco NOC was taken during sale deed

Conveyance is compulsory for CIDCO NOC. CIDCO NOC is taken while doing the purchase agreement.

Hello Sir, I executed a release deed between my brother and myself where I purchased his 50% rights. I applied to CIDCO for the final order so society can update the share certificate in my name. Order received from CIDCO does not mention the before & after percentage share but just reflects 0.000%. Society is not considering it and have asked for correction but CIDCO has issued the final order based on the copy of the executed release deed. Can you please provide your expertise whether society should hold off amending name in the share certificate ?

Kindly fix a consultation with me as per below link.

Let me know once you have made the booking via whatsapp.

https://navimumbairealestate.org/real-estate-online-consultation-booking/

Thank you