How to calculate Stamp Duty on Real Estate (Flats and Shops) including Car Parking and Open Terrace Balcony

Stamp Duty and Registration are two inherent parts of Any Real Estate Purchase, Sale or Gift Transaction in Maharashtra, however, the method of calculation of Stamp Duty and Registration can differ widely depending on the type of property, the age of the property, the location of the property, the floor of the property, the type of transaction and the parties in the transaction.

For a simple purchase of a new or resale flat, the Stamp Duty is payable at the flat rate as declared from time to time by the State Government for different districts.

The Current Stamp Duty Rates in Navi Mumbai, Maharashtra is 5%.

Registration is capped at 1% of the value of the transaction subject to a Maximum of Rs 30,000 in Maharashtra.

There can be an additional surcharge (Municipal CESS + LBT (Local Body Taxes) etc) of 1%, depending on the location of the property and whether it falls under a Municipal Corporation or not.

There could also be an additional surcharge which may increase the Stamp Duty payable by upto 2%. So Please check accordingly.

Women Get a 1% discount in the Stamp Duty amount.

Note: It is a misconception that new flats or old flats cannot be sold below the ready reckoner.

A Flat can be sold at any price, but the Stamp Duty has to be paid as per the ready reckoner.

The Flat can be sold at any price but the stamp duty will have to be paid at the Ready Reckoner Price/Rates as declared by the Govt every Financial Year (1st April to 31st March).

These rates are different for Flats, Offices, Open Plots, Shops etc.

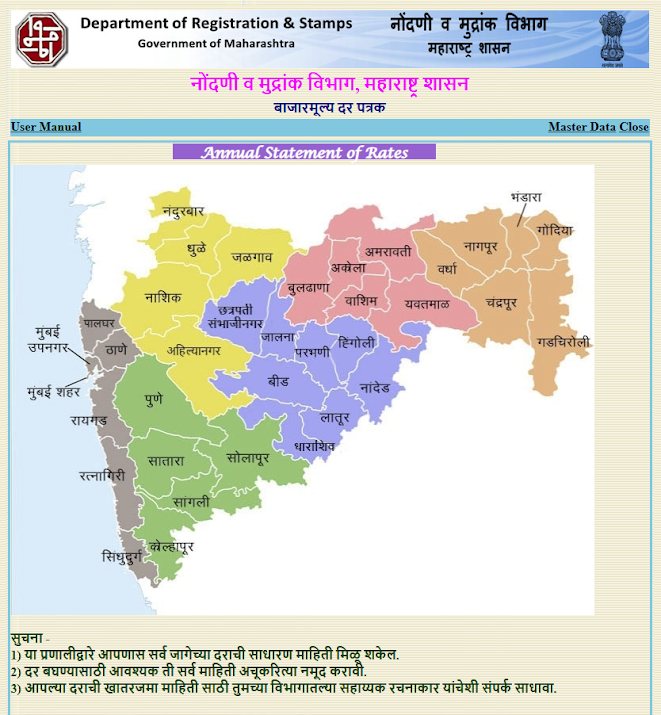

The latest rates can be found on this site

First the correct district has to be chosen and then the location of the property as per plot no or sector number or TPS number etc., has to be selected and then the price will show up (per square meter of built-up area).

First the size of the flat/Plot/Shot is calculated in Square Meters. Then this is multiplied by the rates given on the Ready Reckoner site for different types of properties i.e.Residential/Commercial/Shop/Open Plot etc.

Stamp Duty on Gift Deeds

Discounted Stamp Duty on Gift Deeds is applicable only on transfer to Blood Relatives

Stamp Duty on a transfer from Son to Father is 4% in Maharashtra Currently. Registration is 1% (Subject to a max of 30,000

Stamp Duty on Gift Deed from Father to Son is 2% in Maharashtra (2025) and Registration is Rs 200 for the same.

| Transaction | Stamp Duty | Registration |

| From Father/Mother to Son/Daughter (Without monetary consideration) | 2% + Rs 200 | Rs 200 |

| From Son/Daughter to Father/Mother (without monetary consideration) | 4% | 1% (Subject to a maximum of Rs 30,000) |

Shops/Plots located on ground floor adjoining a street of 12 meters width or more..shall be valued at 110% of the Rates specified in the Ready Reckoner list

Built Up area V/S Carpet area for Stamp Duty Calculation

Rates for Stamp duty are calculated in Sq Meters (Built up area).

The Ready Reckoner rates are also given in Square Meters.

But flats, offices and shops may not have their measurements in square meters but in Square Feet. And also, the area may be Carpet area instead of Built Up area…hence…

The conversion formula from Carpet Area into Built Up area for Maharashtra is …

Carpet area = Built up area / 1.1

The conversion formula for Built Up area to Carpet Area is…….

Built up area = Carpet area x 1.1

Calculation of Stamp Duty for Balcony, Loft, Basement, Terrace etc

| Type | % of area considered for Stamp Duty |

|---|---|

| Enclosed Balconies | 100% |

| Open Balconies | 40% of their area |

| Terrace accessible from within the flat but located above the flat | 25% of its area |

| Terrace accessible from within shop/office but located above it | 40% of its area |

| Loft area (Commercial/Shop) | 50% of its area |

| Loft area (Residential) | 25% of its area |

| Basement (Other than car parking) when used as godown | 70% of its area |

- Enclosed Balconies are evaluated @ 100 % of their area

- Open balconies are considered @ 40% of their actual area.

- Attached Open Terrace is taken @ 40% of its actual area.

- Terrace accessible from within the flat but located above the flat is taken @ 25% of its actual area

- Terrace accessible from within an office or shop but located above the same is taken @ 40% of its actual area.

- Loft area of is taken at 50% Loft area of premises (other than residential).

- Loft in a residence is taken at 25% of its area

- Basement area (other than car parking) when used as shop/godown is taken at 70% of its actual area

Stamp Duty on Car Parking

Open parking on ground floor is valued at 40% of the ready reckoner value.

i.e.. 40% of the actual area of the car parking.

Covered Car parking/Stilt Car Parking is taken at 25% of its area

| Type of Car Parking | Area to be taken for stamp duty calculation |

| Open Car Parking | 40% |

| Covered Car Parking (Stilt Car Parking) | 25% |

Generally, open car parking for 1 car is taken as 6.97 square meters…or 70 sq ft (approx.)

So the actual area considered for stamp duty will be 40% of 6.97 sq meters ie.2.78 sq meters

Reduction in stamp duty is also available as per the building and whether it has lift/Elevator or not

Value to be considered in building without lift/Elevator

| Serial Number | Floor | Decreased Value of Flat to be considered |

|---|---|---|

| 1. | Ground Floor | 100% (No Decrease) |

| 2. | Stilt / First Floor | 95% |

| 3. | Second Floor | 90% |

| 4. | Third Floor | 85% |

| 5. | Fourth Floor and above | 80% |

Increase in stamp duty is applicable in case of a building with elevator and more than 4 floors

Increase in valuation in Buildings with Lift/Elevator

| Serial Number | Floor | Increased Value of Flat to be considered |

|---|---|---|

| 1. | Ground Floor to 4th floor | No increase |

| 2. | Fifth to 10th Floor | 5% increase |

| 3. | Eleventh to 20th Floor | 7.5% increase |

| 4. | Twenty First and above | 10% increase |

Depreciation allowed for Stamp Duty in Maharashtra

(Depreciation is only allowed for flats sold at ready reckoner value or flats given via gift Deed)

| Age of Building | Type of Construction | Depreciation allowed |

| 0-2 years | RCC | 0% |

| 2-5 years | RCC | 5% |

| 5 years and above | RCC | 1% per year (Subject to max of 70%) |

For a more detailed paper on the calculation of Stamp Duty and Registration, please check here

Typical Stamp Duty worksheet from the Registration office showing exactly how Stamp Duty has been evaluated for the particular property is shown below….