Is CIDCO Transfer no longer required now ?

Unfortunately, the short answer to that is : It is required

New Drama before elections

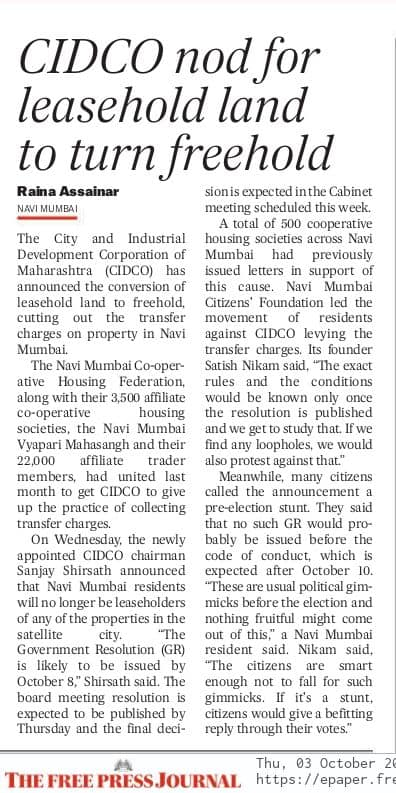

Recently we witnessed new drama before elections when CIDCO Chairman, Sanjay Shirsaat, a political appointee, a Shiv Sena MLA in Maharashtra Legislative Assembly from Aurangabad West Vidhan Sabha constituency, enacted a drama orchestrated by a group called ‘Navi Mumbai Citzen’s forum’ in co-ordination with other groups called Sahakar Bharti, The Navi Mumbai Co-Operative Housing Federation and Navi Mumbai Vyapari Mahasangh along with ex Shiv Sena member and ex IAS officer Vijay Nahata, who went on to fight the latest assembly elections on an independent ticket later.

Most people are unaware that CIDCO Chairman is a political party leader.

They think he is the owner and ruler of CIDCO and whatever he says is the law.

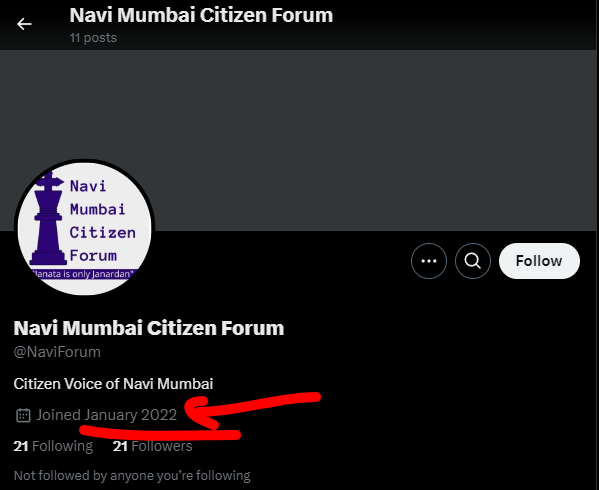

The drama began suddenly just before the elections, when a group called ‘Navi Mumbai Citizens Forum’ sprang up from nowhere and started demanding cancellation of the CIDCO Transfer charges. Their Twitter page was set up in January 2022 and it is headed by BJP IT Cell Maharashtra Head Satish Nikam. So in all probability, this is just a front organization of the BJP, but the name of the organization makes it appear as if its a group of ordinary citizens of Navi Mumbai.

Then the media started flashing pictures of Sanjay Shirsaat meeting with BJP members.

Here below we see pictures of Satish Nikam with CIDCO Chairman and political appointee Mr.Sanjay Shirsaat.

Then another news was flashed that a proposal would be finalized in the next 8 days and another party member Vijay Nahata jumped into the bandwagon and started spreading news that the proposal had been passed by the CIDCO board and that a Govt resolution would be passed soon.

All this gave an impression that the proposal had been passed and that CIDCO Transfer charges had been cancelled.😂

The most important points that the press hid from you :

- CIDCO Transfer charges cannot be changed by merely passing resolutions and GR’s inside some office.

- CIDCO Transfer charges are applicable as per law and rules passed in Assembly.

That law is called Navi Mumbai Disposal of Lands act and Navi Mumbai disposal of land rules. - No official announcement was made by any IAS Directors or MD’s or Jt MD’s of CIDCO.

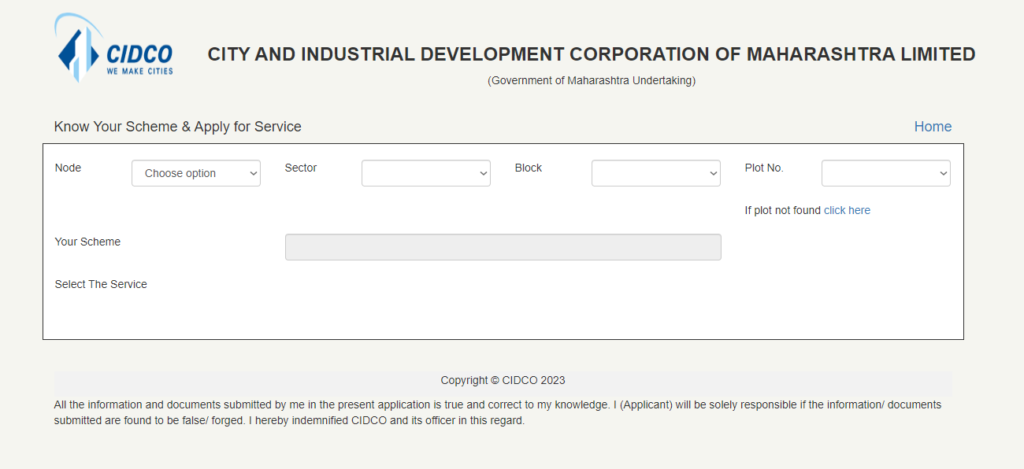

- No official announcement was made on the official website of CIDCO

- The online link for CIDCO Transfer charges are still operational 😂

With all this perfect orchestration of the drama in co-ordination with pliant media, BJP’s job was complete.

They had successfully managed to fool the people once again.

Proof that CIDCO Transfer Charges are still applicable

Here is the Link to the CIDCO Website which is still operational

There is no mention on the official website of CIDCO of any cancellation of CIDCO Transfer Charges and all the links for CIDCO transfer charges are still operational.

CIDCO Transfer Charges — 1 Apr 2025 to 31 Mar 2026

Compiled by Sky Properties — for quick reference. (All amounts shown are per the original CIDCO table; GST 18% extra)

Developed Nodes (suggested)

- Vashi

- Nerul

- Belapur

- Kharghar

- Airoli

Developing Nodes (suggested)

- Ulwe

- Panvel

- Dronagiri

- Kalamboli

- Taloja

Note: The node lists above are suggestions commonly used in Navi Mumbai conversations — please replace these with CIDCO’s official node classifications for your site if you have that list. Charges in the tables are listed in square meters. To convert sq ft → sq m use the quick tool below. Source: CIDCO transfer charges PDF.

| Carpet Area (Sq m) | Flats — Developed Nodes | Shops/Offices — Developed Nodes | Flats — Developing Nodes | Shops/Offices — Developing Nodes |

|---|---|---|---|---|

| Up to 20 sq m | 27,000 + 18% GST | 77,200 + 18% GST | 25,700 + 18% GST | 70,100 + 18% GST |

| 21–30 sq m | 41,200 + 18% GST | 1,18,600 + 18% GST | 36,600 + 18% GST | 97,800 + 18% GST |

| 31–40 sq m | 96,700 + 18% GST | 1,92,800 + 18% GST | 76,200 + 18% GST | 1,51,400 + 18% GST |

| 41–50 sq m | 1,38,700 + 18% GST | 2,76,200 + 18% GST | 1,13,400 + 18% GST | 2,26,100 + 18% GST |

| 51–60 sq m | 1,88,500 + 18% GST | 3,76,200 + 18% GST | 1,51,100 + 18% GST | 3,01,100 + 18% GST |

| 61–70 sq m | 2,34,900 + 18% GST | 4,68,500 + 18% GST | 1,88,500 + 18% GST | 3,76,700 + 18% GST |

| 71–80 sq m | 2,88,100 + 18% GST | 5,75,700 + 18% GST | 2,26,100 + 18% GST | 4,51,800 + 18% GST |

| 81–100 sq m | 4,02,000 + 18% GST | 8,03,100 + 18% GST | 3,19,000 + 18% GST | 6,35,500 + 18% GST |

| 101–150 sq m | 7,02,500 + 18% GST | 14,04,400 + 18% GST | 5,56,400 + 18% GST | 11,12,100 + 18% GST |

| 151–200 sq m | 8,40,500 + 18% GST | 16,80,200 + 18% GST | 7,02,500 + 18% GST | 14,04,400 + 18% GST |

| 200 & above | 11,12,100 + 18% GST | 22,23,100 + 18% GST | 8,42,200 + 18% GST | 16,80,200 + 18% GST |

| Plot Area (Sq m) | Developed Nodes | Developing Nodes |

|---|---|---|

| Up to 40 | 96,700 + 18% GST | 63,500 + 18% GST |

| 41–60 | 1,59,400 + 18% GST | 1,17,700 + 18% GST |

| 61–100 | 2,22,000 + 18% GST | 1,68,000 + 18% GST |

| 101–500 | 3,55,600 + 18% GST | 2,80,800 + 18% GST |

| 501–2000 | 5,31,300 + 18% GST | 3,97,500 + 18% GST |

| 2001 & above | 5,84,600 + 18% GST | 4,37,300 + 18% GST |

| Plot Area (Sq m) | Developed Nodes | Developing Nodes |

|---|---|---|

| Up to 40 | 1,93,400 + 18% GST | 1,26,800 + 18% GST |

| 41–60 | 3,18,700 + 18% GST | 2,35,000 + 18% GST |

| 61–100 | 4,44,000 + 18% GST | 3,35,700 + 18% GST |

| 101–500 | 7,35,900 + 18% GST | 7,02,500 + 18% GST |

| 501–2000 | 14,71,200 + 18% GST | 14,08,400 + 18% GST |

| 2001–4000 | 36,80,700 + 18% GST | 21,10,500 + 18% GST |

| 4001–5000+ | 40,48,800 + 18% GST | 23,21,600 + 18% GST |

| Type of Transfer | Charges |

|---|---|

| Via Gift Deed to blood relation (without monetary consideration) | 5,950 |

| Via Hiership Certificate/Succession Certificate issued by court | 595 |

| Mortgage NOC | 595 |

Sky Properties — CIDCO Transfer Assistance

For fast, accurate processing and documentation help.

Website: navimumbairealestate.org